Donation Reciept

A PersonCompany making a Donation An Organization receiving a Donation. Thank you for your donation.

Donation Receipts Statements A Nonprofit Guide Including Templates

You already know those parts from the title down to the signature line.

. A 501 c 3 donation receipt is required to be completed by charitable organizations when receiving gifts in a value of 250 or more. 3 Document The Concerned Cash Donation. The receipt used to document a Goodwill donation can be accessed with the Adobe PDF link above.

Goodwill SCWIs tax ID number is 39-114-7571. The receipt is important to the donor who gives out cash vehicle or personal property and wishes to have a tax deduction on the donation. Sending out donation receipts is another way that organizations can keep track of their individual supporters donation histories.

A charitable donation receipt is a letter email message or receipt form notifying a donor that their gift has been received. The receipt can take a variety of written forms letters formal receipts postcards computer-generated forms etc. To place it simply donation receipts are concrete proof or evidence that a benefactor had made a contribution whether in-kind or monetary to a group association or organization.

This includes non-monetary donations such as land or other types of property. It also shows the donor that your organization appreciated the contribution of the donor. Its essential to have your own filing system.

If you have compatible software you may enter information onscreen however many would consider it wise to have such paperwork in a readily accessible location in. By not issuing a donation receipt the donor is unable to claim the donation as a deductible and they may choose not to donate again. Weve adapted these Kindful email templates to work for any nonprofit.

These email and letter templates will help you create compelling donation receipts without taking your time away from your donors. Select it then download this file. Whatever the form every receipt must include six items to meet the standards set.

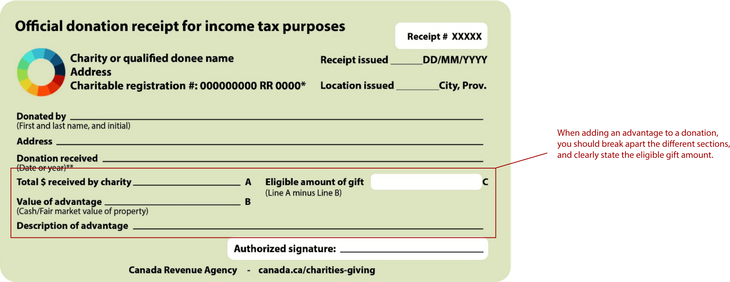

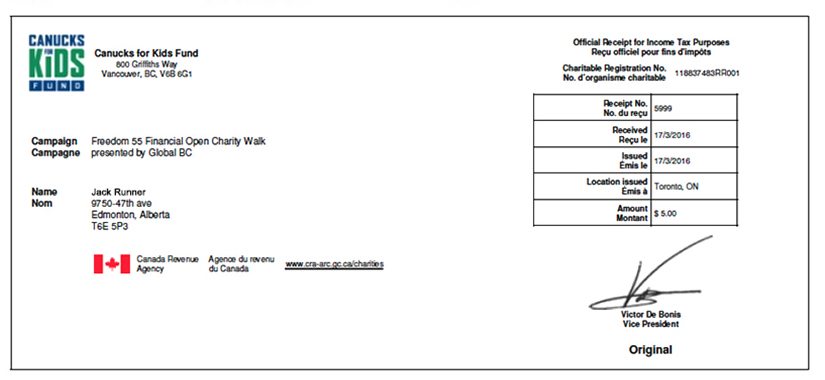

Registered charities and other qualified donees can use these samples to prepare official donation receipts that meet the requirements of the Income Tax Act and its regulations. Is this Receipt for a Single Donation. Updated June 03 2022.

This calls for a need to migrate to the digital solutions for Donation. No goods or services were exchanged for. Create a high quality document online now.

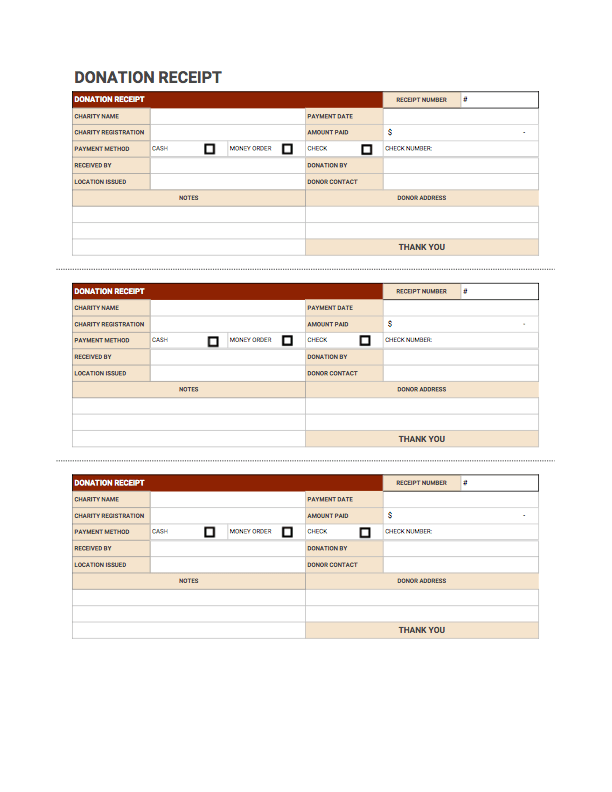

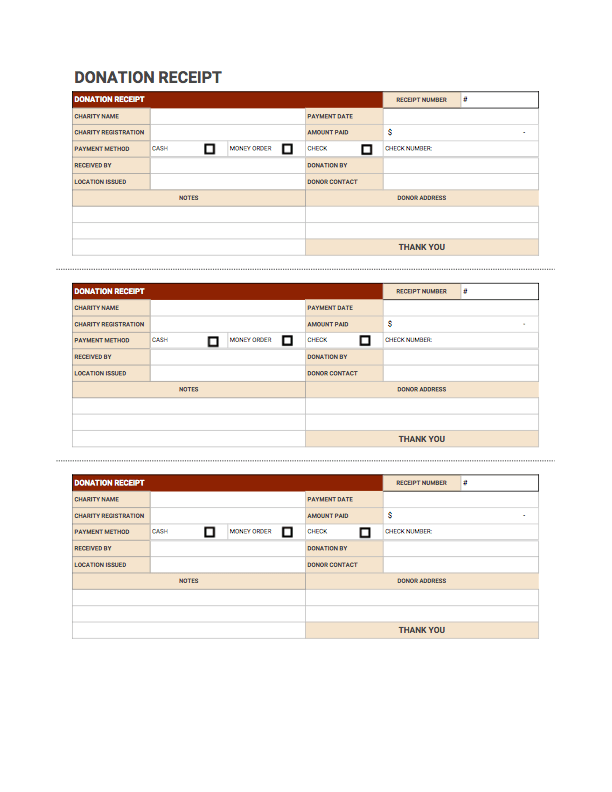

Donation Receipt Template 0. Charitable donation receipts contain any and all information regarding the gift donor name organization name gift amount gift type etc. Its utilized by an individual that has donated cash or payment personal property or a vehicle and seeking to claim the donation as a tax deduction.

501c3 Donation Receipt Template. The website address is canadacacharities-giving. Even if you dont fall under 80G category your NGO need a more data-driven and sophisticated process in the system to mature the development of the fundraising process.

Failure to send a receipt can result in a penalty of 10 per contribution up to 5000 for each specific campaign. To complete your donation receipt be sure to insert all the elements we discussed earlier. The second area of this receipt Donation Value will allow a clear-cut presentation of the donation being made.

Your donors are really going to appreciate. 501c3 Tax-Compliant Donation Receipt Requirements. Donation and non-cash gifts.

If you ever need proof of a donation a copy of a receipt or to reissue a receipt your filing system will be your best friend. A church donation receipt is a record of a charitable donation that has been made to a church. Please note that it is the responsibility of the donor to determine fair market value of the items donated.

Besides donation receipts try to maintain separate recordings of each donation no matter the amount. Youll want to make sure you create a template you can use to send your donation receipts at the end of the year. Keep track of pledges too since they must be accounted for in the year in which the pledge is made even if the gift doesnt arrive in that fiscal year.

We can help you make sure your receipts include everything and look fantastic. 1 Save The Goodwill Receipt Template. Who is WRITING this Receipt.

In the US it is required that an organization gives a donation receipt for any contribution that is 250 or more. Donations primarily received are. Often a goodwill donation receipt is presented as a letter or an email which is given or sent to the benefactor after the donation has been received.

Just make sure you update them with the custom fields that your donor management system uses. 501 c 3 charity donation receipt is written by the charity organization upon receiving contributions worth 250 and above. Verify the funds physically count the money then write out the received amount on the first blank space in this section.

Keeping track of the donation receipts youve issued just makes good sense and keeps everything in order. Re-enter the cash amount received on the blank line attached. But what you should watch out for.

Yes No this Receipt will be used as a Template for multiple donations. Add the Elements of a Donation Receipt. Any gift over 250 must be recognized with a receipt.

Please keep your receipt for tax purposes and note that Goodwill SCWI does not retain a copy. Its important to remember that without a written acknowledgment the donor cannot claim the tax deduction. Across all States churches fall under the umbrella of a 501c3 tax-exempt organizations meaning that any individual who makes a charitable donation to a church can deduct the total value of the gift from their annual income when filing their taxes.

Use our online receipt maker to start creating the perfect donation receipt for your charity to use today. Store copies of donation receipts. Official donation receipts must include the name and website address of the Canada Revenue Agency CRA.

Nonprofit Donation Receipts Everything You Need To Know

Temporary Official Tax Receipt Formats And Requirements Running Room Support

Donation Receipt Template Pdf Templates Jotform

5 Donation Receipt Templates Free To Use For Any Charitable Gift Lovetoknow

Free Donation Receipt Templates Silent Partner Software

Free Goodwill Donation Receipt Template Pdf Eforms

Required Information On Tax Donation Receipts

Nonprofit Donation Receipt Letter Template

Donation Receipt Free Downloadable Templates Invoice Simple

Posting Komentar

Posting Komentar